Which One of the Following Is a Current Asset

Accounts receivable reflects the amount to be received from the debtors for the sales made. Cash paid upon signing the franchise contract O O d.

Difference Between Current Assets And Current Liabilities With Example

These assets help a company to fund its daily operations.

. Which one of the following will increase the cash flow from assets all else equal. Business Analytics Technology Management Chapter 2. Staple held for resale is a current asset because its easy to sell or liquidate.

Current assets are those which are convertible into cash in short period of time ie within a year. Business Analytics Technology Management Chapter 5. In other words the meaning of current assets can be explained as an asset that is.

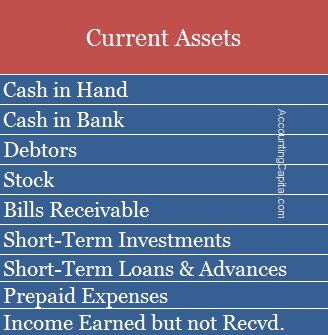

The financial statement that reports revenues and expenses is the. Land is regarded as a fixed asset or non-current asset in accounting and not a current asset. Business Analytics Technology Management Chapter 4.

Current assets also include prepaid expenses that will be used up within one year. What Are Current Assets. Investments except for investments that.

Land that is acquired for future expansion of the business. B An increase in net working capital must also increase current assets. Cash including foreign currency.

A Cash B Supplies C Equipment D Prepaid Insurance Differed Revenue PrepayAsset. Which of the following would result if a business has a current ratio less than 1. Trade installment receivables normally collectible in 18 months.

Investment in equity securities for the purpose of controlling the issuing company. Hence the correct answer is C. If a companys operating cycle is longer than one year the length of the operating cycle is used in place of the one-year time period.

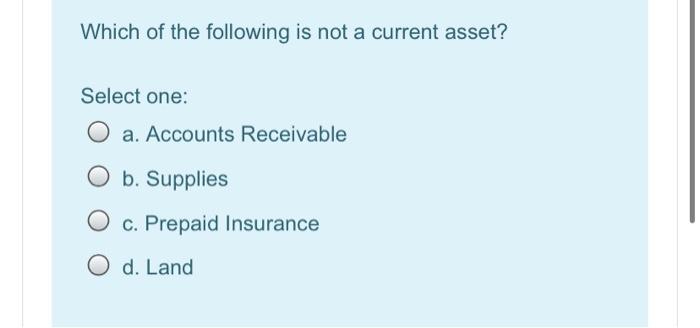

A current asset is a companys cash and its other assets that are expected to be converted to cash within one year of the date appearing in the heading of the companys balance sheet. Suppose that a company has 25000 of current assets and 50000 of current liabilities. Current assets include cash and assets that are expected to turn to cash within one year of the balance sheet date.

For a company a current asset is an important factor as it gives them a space to use the money on a day-to-day basis and clear the current business expenses. A current asset is an asset that is easily converted to cash or expected to be converted to cash within a fiscal year or operating cycle. Current assets are those assets that are easy to liquidate sell or consumed within a year.

The assets may be amortized or depreciated depending on its type. Cash paid upon signing the franchise contract. A accounts payable b accounts receivable c trademark d equipment e notes payable.

However if a company has an operating cycle that is longer than one year an asset that is expected to turn to cash within that longer operating cycle will be a. Cash deposit for the machinery that is to be delivered in the following period. Which of the following is a current asset.

The firm owes a total of 141000 only 40 percent of which is payable within the next 12 months. Cash deposit for the machinery that is to be delivered in the following period. Current assets are used to facilitate day.

Cash designated for the purchase of tangible fixed assets. Which one of the following is not a current asset. Read more are securities that are heavily traded on public exchanges.

Land that is acquired for future expansion of the business d. There are many types of current assets which vary by industry. A Decrease in cash flow to stockholders.

The current ratio would be calculated by dividing 25000 by 50000 to arrive at a 051 ratio. It may not have enough liquidity to cover short-term expenses. Commercial Paper Treasury notes and other money market instruments are included in it.

Unused supplies O b. Which of the following is a current asset. Which one of the following is a current asset.

Marketable securities Marketable Securities Marketable securities are liquid assets that can be converted into cash quickly and are classified as current assets on a companys balance sheet. Business Analytics Technology Management Chapter 6. Current assets are assets that can be converted into cash within one fiscal year or one operating cycle.

A statement of retained earnings. Definition of Current Asset. Cash surrender value of a life insurance policy of which the company is the beneficiary.

Business Analytics Technology Management Chapter 3. Which one of the following is not a current asset a. Since such amounts for sales made are receivable in the short period accounts receivable are classified as current assets.

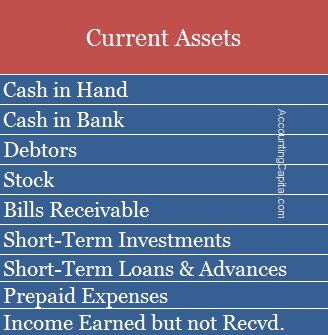

Generally the following asset types are classified as current assets within most industries. C Net working capital increases when inventory is sold for cash at a profit. 7 Which one of the following statements concerning net working capital is correct.

Cash Cash and deposits with financial. Current assets - current liabilities Vasquez Pottery has shareholders equity of 218700. The following are the key categories of non-current assets.

Companies purchase non-current assets with the aim of using them in the business since their benefits will last for a period exceeding one year. A current asset is an asset that a company holds and can be easily sold or consumed and further lead to the conversion of liquid cash. A A firms ability to meet its current obligations increases as the firms net working capital decreases.

Tangible assets refer to. Types of Non-Current Assets. The following are the common types of current asset.

Which of the following is a current asset.

What Are Current Assets Definition Meaning List Examples Formula Types

:max_bytes(150000):strip_icc()/ScreenShot2022-04-07at10.21.44AM-4b083a721f744f4ebb05c3a418c382d2.png)

Current Assets Vs Noncurrent Assets What S The Difference

Solved Which Of The Following Is Not A Current Asset Select Chegg Com

Current Assets Know The Financial Ratios That Use Current Assets

Comments

Post a Comment